Peak Demand Blog

Top 5 AI Chatbot Strategies to Skyrocket Life Insurance Sales and Customer Engagement: A Must-Read for Agents

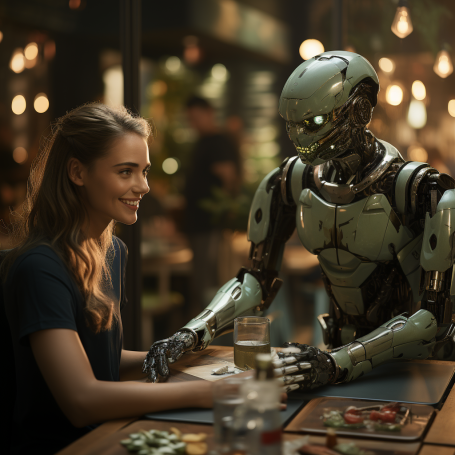

Introduction: Transforming Life Insurance Sales & Engagement with AI-Chatbots

The life insurance industry is at a crossroads, faced with the choice of embracing technological evolution or being overshadowed by it. AI chatbots represent more than just a trend; they are a paradigm shift in how life insurance agents interact with and serve their clients. As we venture into this transformative era, let's explore the first of the top five AI chatbot tactics that can significantly elevate your business.

1. Intelligent Lead Generation and Qualification

In the dynamic world of life insurance, the ability to generate and qualify leads efficiently stands as a cornerstone of successful sales. AI chatbots are revolutionizing this process by bringing in a level of precision and personalization previously unattainable.

Identifying and Qualifying Potential Leads

AI chatbots, equipped with sophisticated algorithms, are adept at sifting through large volumes of data to identify potential leads. They analyze user interactions, behaviors, and preferences to determine which prospects are most likely to convert into customers. This not only streamlines the lead generation process but also ensures that the leads are of high quality.

A typical chatbot interaction might start with general questions about the user’s insurance needs and gradually become more specific, effectively gauging the prospect's interest and suitability for various insurance products. This method of interactive qualification not only saves time but also enhances the customer's experience by providing them with relevant information and options.

Leveraging AI-Driven Customer Analytics

The power of AI-driven analytics comes into play when chatbots process and interpret the data gathered during interactions. This information provides valuable insights into customer demographics, needs, and expectations.

For example, a chatbot can analyze responses to identify common concerns among prospects, such as budget constraints or specific coverage requirements. Armed with this knowledge, life insurance agents can tailor their approach, focusing on areas that resonate most with their target audience.

By employing AI chatbots for intelligent lead generation and qualification, life insurance agents can expect not only an increase in the number of qualified leads but also an enhancement in the overall sales process efficiency. This strategic use of technology ensures that agents are focusing their efforts on leads with the highest potential, paving the way for more meaningful interactions and successful conversions.

In the next section, we will delve into how AI chatbots can further enhance sales conversion, taking the life insurance sales process to new heights of effectiveness and customer satisfaction.

2. Enhancing Sales Conversion with AI Chatbots

The integration of AI chatbots into the sales process is more than just an operational upgrade; it's a strategic move towards scaling communications and significantly boosting sales. Let's explore how AI chatbots can be pivotal in enhancing sales conversion rates for life insurance agents.

AI-Assisted Sales Processes

Chatbots, powered by AI, are capable of handling multiple conversations simultaneously, a feat impossible for human agents to replicate on the same scale. This ability to scale communication is crucial in today's fast-paced market, where timely responses can make the difference between closing a sale and losing a potential client.

An AI chatbot can efficiently engage with numerous prospects at once, providing them with instant information, answering their queries, and guiding them through the preliminary stages of the sales funnel. This immediate engagement keeps the prospects interested and moves them smoothly towards making a decision.

Impact on Sales: The direct impact of this expanded communication capacity is an increase in sales opportunities. With AI chatbots, life insurance agents can reach and nurture more leads than ever before, leading to a higher number of successful policy closures.

Tailoring Sales Pitches with AI

The strength of AI lies in its ability to learn from interactions and adapt accordingly. AI chatbots analyze the responses and behavior of potential clients to tailor sales pitches that resonate with each individual's specific needs and preferences.

For instance, if a chatbot identifies a prospect interested in life insurance for family security, it can focus the conversation on policies that offer comprehensive family coverage. This personalized approach not only makes the client feel understood but also significantly increases the likelihood of a sale.

Scalability Equals Increased Sales: By leveraging AI for tailored and scalable communications, life insurance agents can effectively multiply their sales efforts. The AI chatbots handle the breadth of communication, allowing agents to focus on the depth – personal interactions with highly qualified leads, ready for conversion. This strategic division of labor ensures that every lead is nurtured to its full potential, directly contributing to an increase in sales.

In our next section, we will delve into how AI chatbots can efficiently handle policy inquiries, further enhancing customer satisfaction and reinforcing trust in the agent's services.

3. Efficiently Handling Policy Inquiries with AI Chatbots

A significant aspect of enhancing customer satisfaction and trust in life insurance services lies in the ability to provide clear, accurate, and prompt responses to policy inquiries. AI chatbots are transforming this aspect of customer service, making it more efficient and reliable.

Responding to Policy-Related Questions

AI chatbots are programmed to comprehend and address a wide array of policy-related questions. This capability is crucial for life insurance agents who deal with a variety of products and complex policy details. The chatbot can provide instant answers to common questions about policy terms, coverage limits, payment options, and more.

By ensuring that accurate information is readily available, AI chatbots help in building trust and credibility with potential clients. This immediate assistance is particularly important in the life insurance sector, where timely and correct information can significantly impact decision-making.

Benefits of Efficient Inquiry Handling: Efficient handling of policy inquiries not only improves customer satisfaction but also streamlines the workload for agents. It allows life insurance agents to focus on more complex tasks and personalized customer interactions, knowing that the chatbot is handling routine inquiries effectively.

AI for Complex Policy Queries

Beyond answering routine questions, advanced AI chatbots are also equipped to handle complex policy inquiries. They can analyze and interpret the nuances of specific customer scenarios, providing detailed explanations and guidance.

For instance, if a customer has a unique situation that affects their insurance needs, the AI chatbot can sift through vast amounts of data to offer tailored advice. This level of customized response adds significant value to the customer's experience.

Scaling Communication and Impact on Sales: The ability to handle both routine and complex inquiries efficiently allows life insurance agents to scale their communications effectively. This scalability ensures that no customer query goes unanswered, fostering a sense of reliability and responsiveness that is crucial in converting inquiries into sales.

In the upcoming section, we will explore how AI chatbots contribute to personalizing product recommendations, further enhancing the potential for sales and customer engagement in the life insurance industry.

4. Personalized Product Recommendations: The AI Advantage

In the realm of life insurance, the ability to provide personalized product recommendations is not just a service perk—it's a core component of customer satisfaction and sales success. AI chatbots bring a new level of sophistication to this process, elevating the art of personalization in insurance sales.

Data-Driven Insurance Recommendations

The power of AI chatbots lies in their capacity to analyze vast amounts of data and extract meaningful insights. This capability allows them to understand the unique needs and preferences of each customer. Based on this understanding, AI chatbots can recommend life insurance products that are best suited to the individual's specific circumstances.

For example, a chatbot can suggest a particular type of life insurance policy based on the customer's age, family structure, financial goals, and health status. These recommendations are not just based on generic data but are tailored to each customer's unique profile, increasing the relevance and appeal of the offered products.

Impact on Sales: This level of personalization in product recommendations significantly enhances the likelihood of sales conversions. When customers feel that the recommended products are specifically designed for their needs, they are more likely to trust the agent’s advice and proceed with a purchase.

Enhancing Customer Satisfaction and Sales

Personalized recommendations go a long way in building lasting relationships with customers. AI chatbots, through their tailored suggestions, demonstrate a deep understanding of customer needs, fostering a sense of trust and loyalty. This customer-centric approach not only leads to immediate sales but also paves the way for future business and referrals.

Moreover, the efficiency of AI chatbots in delivering these personalized recommendations ensures that no opportunity for cross-selling or up-selling is missed. By consistently providing valuable and relevant product options, AI chatbots help life insurance agents maximize their sales potential.

In the next section, we will delve into how AI chatbots play a vital role in automated follow-up and client retention, further solidifying their position as indispensable tools for life insurance agents.

5. Automated Follow-Up and Client Retention: AI's Pivotal Role

Consistent follow-up and maintaining ongoing engagement are key factors in client retention and repeat business in the life insurance industry. AI chatbots offer an innovative solution to automate these processes, ensuring that no client feels neglected and every opportunity for continued engagement is maximized.

Keeping Leads Engaged with Automated Follow-ups

AI chatbots can be programmed to send timely follow-up messages and reminders to potential and existing clients. This automated process is crucial for keeping leads engaged, especially in cases where immediate conversion is not possible. Regular follow-ups ensure that the insurance agency remains at the forefront of the client’s mind, ready for the moment when they are prepared to make a decision.

For instance, a chatbot can send personalized reminders about incomplete policy applications or follow up on a quotation provided earlier. This consistent communication helps in nurturing leads, gradually guiding them towards purchasing a policy.

Impact on Sales: The efficiency of automated follow-ups significantly increases the chances of converting leads into sales. By maintaining regular contact, AI chatbots help in building a connection with potential clients, which is often the deciding factor in successful sales conversions.

AI Strategies for Client Retention

In addition to acquiring new clients, retaining existing ones is equally important. AI chatbots excel in this area by providing timely updates, policy renewal reminders, and personalized messages on special occasions. This kind of attentive service goes a long way in maintaining client satisfaction and loyalty.

Moreover, AI chatbots can gather feedback from clients, providing valuable insights into areas of improvement. By acting on this feedback, life insurance agents can enhance their services, further strengthening client relationships and fostering long-term loyalty.

Scaling Communication for Long-term Success: The ability of AI chatbots to manage large-scale communications effortlessly means that every client, old or new, receives the attention they deserve. This scalability is key to not just growing a customer base but also maintaining it, which is essential for the long-term success of any life insurance agency.

In conclusion, AI chatbots are proving to be invaluable assets in the life insurance industry, revolutionizing lead generation, sales processes, and client engagement. Their role in automating critical aspects of customer interaction and sales strategy is a game-changer, offering life insurance agents a powerful tool to enhance their performance and achieve new heights of success.

AI Adoption: A Critical Turning Point for Life Insurance Agents

As we delve into a future where AI is not just an advantage but a necessity, it becomes increasingly clear that life insurance agents who fail to adopt AI chatbot strategies risk falling behind. The landscape of insurance sales is evolving rapidly, with AI leading the charge in redefining customer engagement and operational efficiency. Those who embrace this revolution stand to gain immensely, while those who ignore it may find themselves struggling to compete. The choice is clear: adapt to the AI-driven world or risk being left behind in an industry that waits for no one. The time to act is now

FAQ About AI-Chatbots for Insurance Agent Lead Generation

Q: How can AI chatbots improve lead generation for life insurance agents?

A: AI chatbots enhance lead generation by identifying and engaging potential clients through automated conversations. They analyze user interactions to qualify leads based on specific criteria, ensuring that agents focus on prospects with the highest conversion potential.

Q: Can AI chatbots personalize interactions with potential clients?

A: Yes, AI chatbots can tailor interactions by analyzing customer data and preferences. This personalization ensures that potential clients receive relevant information and product recommendations, increasing the likelihood of sales conversions.

Q: Are AI chatbots capable of providing 24/7 customer support?

A: Absolutely. AI chatbots offer round-the-clock support, answering policy-related questions and providing assistance at any time. This continuous availability significantly enhances customer service and satisfaction.

Q: How do AI chatbots handle complex policy inquiries?

A: Advanced AI chatbots are equipped with natural language processing capabilities, enabling them to understand and respond to complex policy inquiries accurately. They can provide detailed explanations and guidance on various insurance aspects.

Q: Can AI chatbots assist in the sales process?

A: Yes, AI chatbots play a vital role in the sales process by engaging leads, providing product information, and guiding potential clients through the decision-making process. This assistance helps in increasing sales efficiency and effectiveness.

Q: What role do AI chatbots play in client retention?

A: AI chatbots contribute to client retention by sending automated follow-ups, reminders for policy renewals, and personalized messages. This consistent engagement helps maintain client relationships and encourages repeat business.

Q: How does automated follow-up by AI chatbots impact sales?

A: Automated follow-ups by AI chatbots keep leads engaged and nurtured over time, increasing the chances of converting inquiries into sales. Regular communication ensures that the agency stays top-of-mind for potential clients.

Q: Are AI chatbots effective in cross-selling and up-selling insurance products?

A: AI chatbots are highly effective in cross-selling and up-selling as they can analyze customer profiles to suggest additional or upgraded insurance products that align with the clients' needs and life changes.

Q: Can life insurance agents customize the AI chatbot's communication style and responses?

A: Yes, life insurance agents can customize their AI chatbot’s communication style and responses to align with their specific brand voice and customer engagement strategy. This customization ensures that the chatbot represents the agency accurately and effectively.

Q: What is the future potential of AI chatbots in the life insurance industry?

A: The future potential of AI chatbots in the life insurance industry is vast. They are expected to become more sophisticated in understanding and predicting customer needs, offering more personalized advice, and automating more complex aspects of customer service and sales processes.

Peak Demand CA on LinkedIn

@PeakDemandCa on X (Twitter)

@PeakDemandCanada on Facebook

@PeakDemandCanada on Instagram

@PeakDemandCanada on Youtube

Copyright © 2025 Peak Demand - All rights reserved.

This Website is Powered By and Built On Peak Demand